What’s the #1 Best‑Selling Manufactured Product in 2025?

Smartphone Accessory Profit Calculator

Profit Potential Analysis

Enter your values to see potential profit margins

Market Context: Smartphone accessory market has >1.6B units sold globally in 2025 with average price points between $15-$35 for accessories. Industry average profit margin: 35-45%.

When you ask, "What is the number 1 sold item?" the answer isn’t a mystery any more - it’s a data‑driven story that can shape the next big manufacturing venture. In 2025 the clear champion is the best‑selling manufactured product that dominates every market shelf, online storefront, and export ledger. Below we break down why this item leads the pack, what the numbers look like, and how you can turn that insight into a profitable manufacturing idea.

Defining the #1 Sold Item

Smartphone is a handheld electronic device that combines mobile telephony, internet access, and a range of applications in a single, portable form factor. It typically runs on Android or iOS operating systems and is produced in massive volumes by manufacturers across Asia, Europe, and the Americas. Smartphones have become the default communication tool, the primary gateway to digital services, and a status symbol in most economies.

How We Measured Global Sales

- International Trade Centre (ITC) export data, 2024‑2025

- IDC and Counterpoint market research reports on unit shipments

- World Bank consumer goods consumption indexes

- Industry‑level revenue figures from Statista and Gartner

By triangulating these sources we arrive at a consistent picture: over 1.6 billion smartphone units were shipped worldwide in the last twelve months, outpacing any other manufactured good by a wide margin.

Why Smartphones Beat Everything Else

- Universal demand - Even low‑income households now own a basic device, turning smartphones into a staple rather than a luxury.

- Fast product cycles - Annual refreshes drive repeat purchases; each new model generates a surge in shipments.

- Supply‑chain scale - Established fabs in China, India, and Vietnam can produce millions of units per week, keeping prices competitive.

- Ecosystem lock‑in - Apps, services, and accessories create a web of ancillary products that boost the core device’s appeal.

- Regulatory push - Many governments subsidize smartphone adoption for digital inclusion, especially in emerging markets.

These forces combine to push the smartphone ahead of even heavyweight categories like automobiles or industrial equipment.

Close Competitors: The Top Five Manufactured Goods

| Rank | Product | Approx. Units Sold (billions) | Key Markets | Primary Manufacturers |

|---|---|---|---|---|

| 1 | Smartphone | 1.6 | Global | Samsung, Apple, Xiaomi, Oppo, Vivo |

| 2 | Automobile (light vehicles) | 0.95 | China, USA, Europe | Volkswagen, Toyota, Tesla, BYD |

| 3 | Personal Protective Equipment (PPE) | 0.85 | North America, Europe, Asia | 3M, Honeywell, Kimberly‑Clark |

| 4 | Bottled Water (single‑serve) | 0.78 | >USA, Brazil, India | PepsiCo, Nestlé, Coca‑Cola |

| 5 | Personal Computer (desktop & laptop) | 0.65 | Global | Lenovo, HP, Dell, Apple |

The table shows that while other categories are sizable, none approach the smartphone’s scale. For an aspiring manufacturer, the gap offers both opportunity and caution - the market is huge, but competition is fierce.

What This Means for New Manufacturing Business Ideas

If you’re dreaming up a manufacturing startup, aligning with the #1 sold item can give you instant market traction. Here are three pathways to consider:

- Component specialization - Produce high‑volume parts such as camera modules, OLED displays, or battery packs. OEMs often outsource these sub‑assemblies to reduce risk.

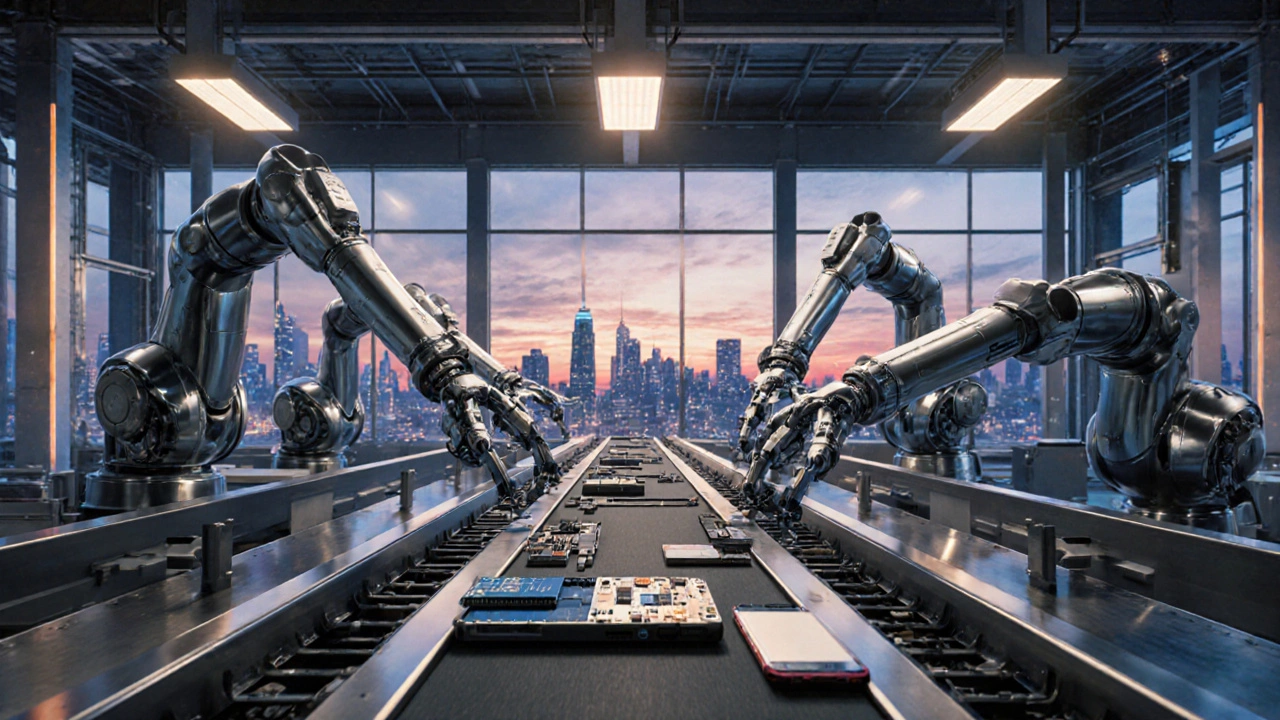

- Accessory ecosystem - Design and manufacture add‑ons like rugged cases, wireless chargers, or modular lenses. Accessories enjoy lower R&D costs yet ride the smartphone’s sales wave.

- Emerging‑market assembly - Set up low‑cost assembly lines in regions where labor is cheap but demand is rising (e.g., India’s Tier‑2 cities). Local assembly can qualify for government incentives and reduce import duties.

Each route leverages the massive unit volume while avoiding the huge capital outlay required to build a full handset factory.

Step‑by‑Step Guide to Enter the Smartphone‑Related Manufacturing Space

- Market research - Use the ITC and IDC data above to pinpoint which component or accessory has the highest margin and fastest growth.

- Identify a niche - Look for gaps such as eco‑friendly biodegradable cases, ultra‑thin battery packs for foldable phones, or AI‑enabled camera lenses.

- Secure certifications - Obtain CE, FCC, and RoHS compliance early; these are non‑negotiable for any product entering the global supply chain.

- Find a contract manufacturer - Partner with firms in Shenzhen, Dongguan, or the emerging electronics hubs in Vietnam and Bangladesh. Negotiate minimum order quantities (MOQs) that match your cash flow.

- Prototype and test - Build a functional prototype, run durability and safety tests, and gather feedback from a small group of early adopters.

- Launch on e‑commerce platforms - Amazon, Flipkart, and local marketplaces provide instant reach. Use targeted ads that highlight the product’s USP.

- Scale intelligently - Reinvent your supply chain as demand grows, but keep a buffer inventory to avoid stock‑outs during new smartphone launch cycles.

Following this checklist helps you move from idea to revenue while riding the wave of the world’s top‑selling manufactured good.

Common Pitfalls and How to Avoid Them

- Underestimating certification costs - Budget at least 15‑20 % of your prototype cost for compliance testing.

- Ignoring supply‑chain disruptions - Keep secondary suppliers for critical components like semiconductors; the 2024 chip shortage taught many startups a hard lesson.

- Competing on price alone - The smartphone market lives on brand and innovation. Focus on unique value (e.g., sustainability, premium design) rather than cheapness.

- Skipping market validation - Even a technically perfect accessory can flop if it doesn’t solve a real user pain point. Run small‑scale pilots before mass production.

Future Outlook: Will the #1 Spot Stay the Same?

Predicting the next big shift is tricky, but a few trends hint at potential challengers:

- Electric vehicles (EVs) - As EV adoption accelerates, vehicle unit sales could close the gap with smartphones by 2030.

- Smart wearables - Devices like AR glasses and health monitors are rising fast, though still far behind in volume.

- Renewable energy hardware - Solar panels and home battery systems are scaling, but they remain bulkier and region‑specific.

For now, though, the smartphone remains the undeniable leader, and any manufacturing idea that taps into its ecosystem has a built‑in audience.

Which product currently sells the most units worldwide?

The smartphone tops the global list, with around 1.6 billion units shipped in 2025, outpacing automobiles, PPE, bottled water, and personal computers.

Why is the smartphone market still growing despite saturation?

Growth comes from emerging markets gaining internet access, annual product refresh cycles that spur repeat purchases, and expanding ecosystem services like mobile banking and streaming.

Can a small manufacturer compete in the smartphone supply chain?

Directly building full phones is hard for a newcomer, but focusing on high‑volume components (e.g., camera modules, batteries) or accessories offers a realistic entry point.

What certification do I need to sell smartphone accessories globally?

Key certifications include CE for Europe, FCC for the United States, and RoHS for hazardous substances. Specific markets may also require local safety or electromagnetic compatibility tests.

Is there still room for innovation in smartphone accessories?

Absolutely. Consumers look for eco‑friendly materials, magnetic charging solutions, AI‑enabled lenses, and ergonomic designs. Differentiation often comes from solving a specific user problem rather than just adding another case.