Are manufacturing jobs coming back to America? Here's what's really happening in 2025

Manufacturing Job Opportunity Calculator

Find out if you qualify for new manufacturing jobs returning to America. Based on current industry data, this tool estimates your potential salary, job availability, and required training based on your location, age, and skills.

Your Manufacturing Opportunity

Enter your information above to see your potential job opportunity.

Five years ago, if you told someone manufacturing jobs were coming back to America, they’d laugh. Factories had been closing since the 1980s. Jobs moved to China, Mexico, Vietnam. But something changed. By 2025, the U.S. is adding back factory workers at a pace not seen since the 1990s. And it’s not just talk - it’s happening in Ohio, Georgia, Texas, and Michigan.

Why now? The policy shift that changed everything

The turning point wasn’t a single event. It was a cascade of federal laws passed between 2021 and 2023. The CHIPS Act poured $52 billion into semiconductor manufacturing. The Inflation Reduction Act gave tax credits to companies making solar panels, batteries, and electric vehicles in the U.S. And the Defense Production Act was revived to force critical supply chains - like rare earth metals and medical equipment - to be domestic.

These weren’t just subsidies. They were rules with teeth. Companies that took the money had to prove they were hiring Americans, training local workers, and keeping production here for at least 10 years. The result? Intel opened five new chip plants. Tesla expanded its battery factories in Nevada and Texas. General Motors now makes 70% of its EV motors in the U.S. instead of 20% in 2020.

Where are the new jobs actually going?

It’s not the Rust Belt alone. While Ohio and Pennsylvania are seeing old plants reopen, the biggest job growth is in the Sun Belt. Georgia added 18,000 manufacturing jobs in 2024 alone - mostly in Atlanta’s suburbs, where battery plants and drone factories are rising. North Carolina’s Research Triangle is now home to 12 new medical device manufacturers. Arizona’s chip corridor, between Phoenix and Tucson, has added 22,000 jobs since 2022.

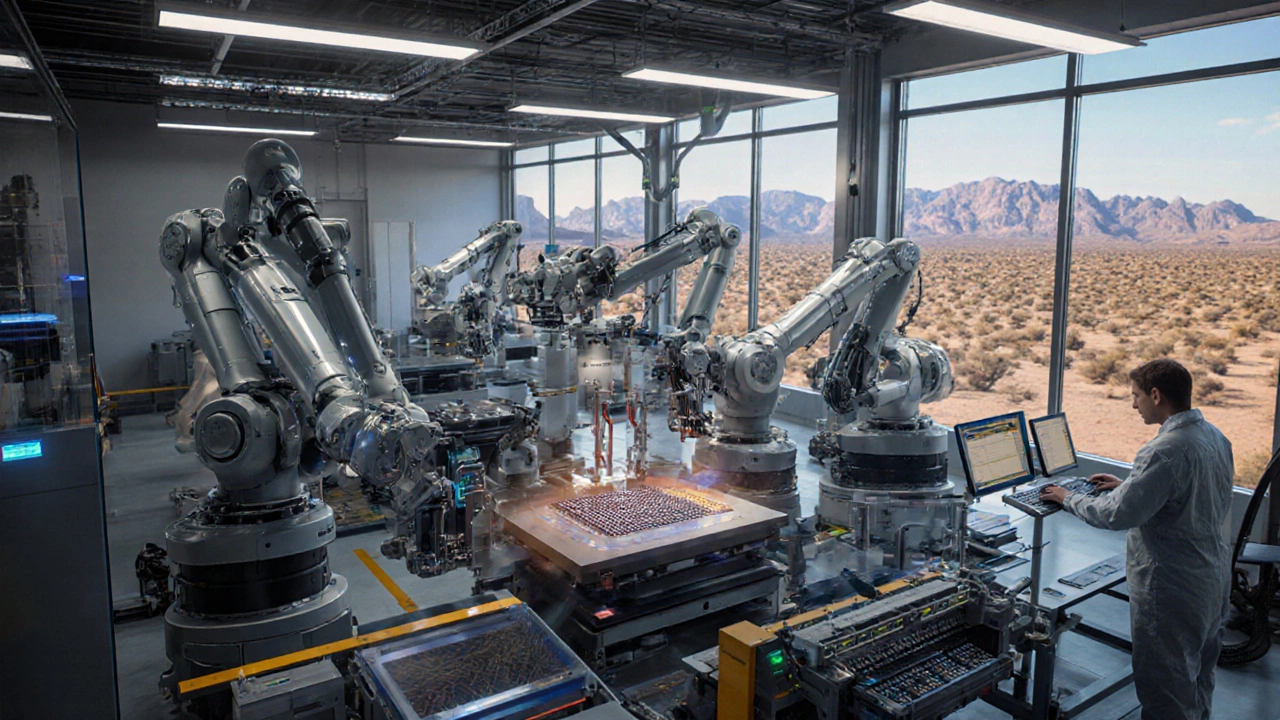

These aren’t the same jobs as 30 years ago. Most new roles require technical skills: robotics maintenance, CNC programming, quality control with AI systems. The average wage for these jobs is $24-$32 an hour, with benefits. That’s more than double what many retail or warehouse jobs pay. And companies are partnering with community colleges to train workers in six-month programs. No four-year degree needed.

What’s driving companies to reshore?

It’s not patriotism. It’s cost and risk.

Shipping a container from Shanghai to Los Angeles used to cost $2,000. In 2025, it’s $8,000 - and that’s after the pandemic spike settled. Labor in China is no longer cheap. Wages there have tripled since 2010. Meanwhile, automation has made U.S. factories more efficient than ever. A single robotic arm can now do the work of six assembly-line workers. Combine that with lower energy costs (thanks to domestic natural gas) and faster delivery times, and making things in America makes financial sense.

Then there’s the geopolitical risk. The U.S. government cut off semiconductor exports to China in 2022. Companies that relied on Chinese chip suppliers got stuck. Now, every Fortune 500 company has a ‘China contingency plan.’ Most of them involve bringing production home.

Who’s getting these jobs - and who’s being left behind?

It’s not a universal comeback. The workers getting hired are mostly in their 30s and 40s. Many are former retail employees, truck drivers, or veterans. They’re being retrained through state-funded programs like Manufacturing USA, a network of 16 regional innovation hubs. These programs pair companies with local community colleges to build custom training tracks.

But older workers - especially those over 55 - are often left out. Many can’t learn new software tools or adapt to shift changes. And rural communities without nearby training centers are seeing little benefit. In West Virginia, only 12% of the new manufacturing jobs went to residents in counties that lost coal mines. The rest were filled by workers who moved in from nearby cities.

Is this trend real - or just a bubble?

Yes, it’s real. And here’s why: 87% of the new factories announced since 2021 are already under construction or running. The U.S. added 340,000 manufacturing jobs between 2021 and 2025. That’s the largest increase in 25 years. The Bureau of Labor Statistics says the number of open manufacturing jobs is still at 400,000 - nearly double the pre-pandemic level.

But it’s not going to bring back the 1950s. There won’t be a million new assembly-line jobs. The future is hybrid: humans working alongside robots, managing AI-driven quality systems, doing maintenance on smart machines. The jobs are better paid and safer, but they require more skill.

What’s next? The next wave of reshoring

Right now, the focus is on chips, batteries, and medical gear. But the next wave is coming: pharmaceuticals, specialty chemicals, and industrial machinery. The FDA just approved $3 billion in grants to bring drug manufacturing back from India and China. Companies like Pfizer and Merck are already building new plants in Pennsylvania and Missouri.

Also, the U.S. is starting to export its manufacturing model. American firms are now setting up factories in Mexico and Eastern Europe - but only if they use U.S.-made equipment and train workers in American standards. It’s not just about making things at home anymore. It’s about controlling the whole chain.

Can this last?

It depends on three things: continued government support, worker training, and innovation. If tax credits expire in 2027 without renewal, some projects will stall. If companies can’t find enough trained workers, they’ll look overseas again. But if community colleges keep expanding their programs - and if automation keeps getting cheaper - then this isn’t a temporary rebound. It’s the new normal.

The American factory isn’t coming back the way it was. It’s coming back smarter, faster, and more skilled. And for the first time in decades, it’s offering a real path to the middle class - if you’re ready to learn how to work with machines, not just beside them.

Are manufacturing jobs really coming back to America in 2025?

Yes. Since 2021, the U.S. has added over 340,000 manufacturing jobs, the largest increase in 25 years. New factories for chips, batteries, EVs, and medical devices are opening across the country, especially in Georgia, Texas, Ohio, and Arizona. These aren’t just temporary hires - most are full-time roles with benefits and wages above $24/hour.

What government programs are bringing jobs back?

Three major laws are driving this: the CHIPS Act ($52 billion for semiconductors), the Inflation Reduction Act (tax credits for clean energy manufacturing), and the Defense Production Act (forcing critical supply chains to be domestic). Companies that take federal funding must prove they’re hiring Americans, training local workers, and keeping production in the U.S. for at least 10 years.

What kind of jobs are being created?

Most new jobs aren’t manual assembly lines. They’re tech-focused roles: robotics technicians, CNC machine operators, quality control specialists using AI systems, and battery assembly engineers. Many require only a six-month certification from a community college - not a four-year degree. Average pay is $24-$32/hour with health insurance and retirement plans.

Why are companies moving production back to the U.S.?

It’s not about patriotism - it’s economics. Shipping costs from Asia have tripled since 2020. Labor in China is no longer cheap. Automation has made U.S. factories more efficient than ever. Plus, geopolitical risks - like trade bans and supply chain disruptions - make relying on overseas production too risky. Companies now see U.S. manufacturing as more reliable and cost-effective.

Who’s being left out of this job boom?

Older workers (over 55) and people in rural areas without access to training programs are struggling to get hired. Many can’t adapt to the new tech-heavy roles. In places like West Virginia, only 12% of new manufacturing jobs went to residents from former coal counties. The benefits are real - but they’re not reaching everyone equally.

Will this trend last beyond 2027?

It depends. If federal tax credits expire without renewal, some projects could stall. But the underlying drivers - automation, supply chain risk, and lower U.S. energy costs - aren’t going away. As long as training programs keep expanding and companies keep investing in smart factories, reshoring will continue. This isn’t a flash in the pan - it’s the start of a new industrial era.